Charitable Contribution: Ultimate Tool to Kill Two Birds with One Stone

General Facts on Charitable Contributions

- A charitable contribution is a donation or gift to, or for the use of, a qualified organization.

- You may deduct charitable contributions of cash made to qualified organizations if you itemize your deductions. Deduction on charitable contributions are reported on Schedule A. (Itemized Deductions)

- The Tax Cuts and Jobs Act (TJCA) increased the annual contribution limits for cash gifts to public charities from 50% to 60%. Non-cash contributions may not exceed 50 percent of your adjusted gross income. (20 or 30 percent limitations may apply in some cases so consult with your advisor)

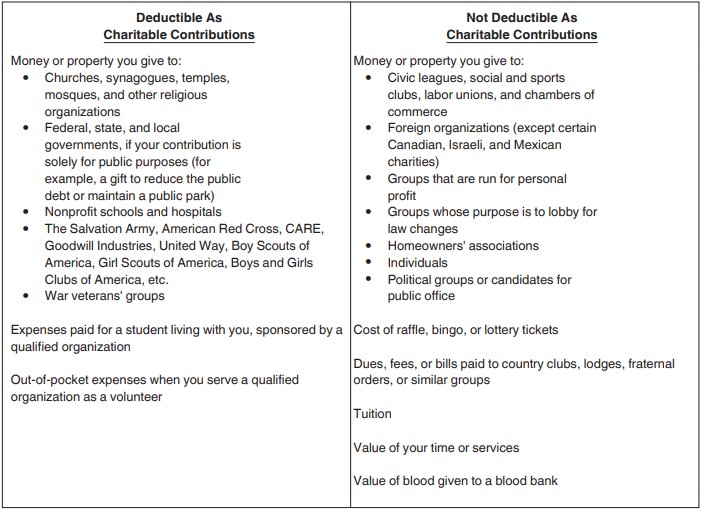

- Below is a table that explains which contributions are deductible and non-deductible.

Source: IRS Publication 526, Charitable Contribution

Before donating, it’s important to understand the different strategies to fully maximize your tax deduction. There are some limitations to the charitable contributions that can prevent you from receiving any tax deduction, but there are also some legal creative loopholes to work around the limitations. Below are some common charitable contribution strategies we discuss with our clients.

Qualified Charitable Distributions

Individuals who are age 70.5 or over are required to take required minimum distributions (RMD) every year from their IRA accounts. When planning an IRA withdrawal, you may want to consider making charitable contributions through qualified charitable distributions (QCD) as QCD directly excludes the amount donated from taxable income. This is especially beneficial to individuals who take a standard deduction instead of an itemized deduction. For example, suppose Sue, age 72 and single, has $800,000 in her traditional IRA account and she takes standard deduction rather than an itemized deduction. Her RMD is about $31,000 and if Sue makes a QCD of $15,000 to a qualified organization, her taxable income would be only $16,000. With a standard deduction of $12,200 in 2019, her taxable income would only be $3,800. However, if Sue makes a charitable contribution without the QCD, her taxable income would be $16,000 ($31,000 RMD – $15,000 itemized deduction). That’s a difference of $12,200 in taxable income! The 2017 Tax Cuts and Jobs Act doubled the standard deduction, which makes this strategy more beneficial and common.

Asset Contribution

The past decade, the stock market has been exceptionally strong and a lot of investors may be holding onto appreciated stocks and funds. If you have appreciated investments, donating them to a qualified charitable organization could be a tax-effective strategy. By donating the appreciated investments, you don’t recognize capital gain. Additionally, you would receive a tax deduction equal to the fair market value of the investments. For example, suppose Sue donates $20,000 to her church every year. Sue has appreciated stocks worth of $20,000 that she bought for $7,500 years ago. If Sue donates the appreciated stocks to her church instead of writing checks, Sue wouldn’t pay capital gains tax on the $12,500 and appreciation is essentially tax-free. Additionally, Sue would receive a tax deduction of $20,000 instead of her purchase price of $7,500. If Sue itemizes deduction and is in the 15% capital gain tax bracket, that would be a tax saving of $1,875! Additionally, the church would be able to sell the securities whenever they need without a tax bill. However, donating securities that have lost value is not a good idea. It’s better to sell the shares to recognize the loss and donate the cash from the sale. If you contribute investments to a public charitable foundation, you may deduct contributions equal to 30% of your adjusted gross income. If the contribution of investments is to a private foundation, the adjusted gross income limit lowers to 20%.

Bunching Donations

Charitable contributions are part of itemized deductions, so if you take the standard deduction, bunching donations could be a beneficial tax strategy. One efficient way to bunch donations is to donate to a donor-advised fund (DAF). Donating to a DAP allows donors to receive an immediate tax deduction and then recommend grants over the years. For example, suppose Sue’s filing status is married filing jointly and has no mortgage interest or medical expenses to deduct for the year. Sue pays state tax, but the new tax law caps state and local tax deduction at $10,000. In 2019, Sue donates $10,000 to charity but has to take a standard deduction since her itemized deductions are below $24,400. Instead, with advice from her accountant, she donates $30,000 to a donor-advised fund. Now, she would receive $40,000 of itemized deductions, and at a 24% tax bracket, that’s a tax saving of $3,744! The tax year 2020 and 2021 would not be affected since she would be taking the standard deduction anyway. Additionally, she would be able to spread out her donations in her donor-advised fund over three years, so the charity is not adversely affected by the bunching strategy.

This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Kauffman|Kim, LLP (Kauffman & Kim, or the “firm”) shall not be responsible for any loss sustained by any person who relies on this publication. Any action you take upon the information on this publication is strictly at your own risk. Kauffman|Kim, LLP (Kauffman & Kim, or the “firm) assumes no responsibility or liability for any errors or omissions in the content.

Comments are closed.